An Answer To Today’s Long-Term Care Crisis

My favorite long-term care protection plan has been improved and has become attractive to more people than before. You have more options than ever to help pay for future long-term care, and these newer options are significantly more appealing and rewarding than traditional long-term care insurance.

I’ve covered in the past the many troubles in traditional long-term care insurance (LTCI). Most insurers exited the market. Many of the remaining insurers continue to raise premiums on existing policyholders.

In Virginia, for example, 29 different insurers are seeking premium increases averaging 50% or more for the coming year. Premium increases would more than double on average on a dozen sets of policies, according to reviews of filings with the state insurance commission reviewed by The Virginian-Pilot.

The situation is similar nationwide, and these premium increases are on top of other substantial increases in recent years. To be sure, a few LTCI carriers have had no or modest increases over the years, but these are exceptions.

Traditional LTCI issuers say their new policies are different and unlikely to incur the steep premium increases existing policyholders have seen.

Understandably, many people are skeptical and prefer another way to plan for any long-term care (LTC) needs they have. Few of us can pay for LTC out of our assets if we need it, so we seek some kind of insurance.

An increasingly popular option is known generically as the Asset-Based or Leveraged Care LTC plan.

These plans have three distinct advantages over traditional LTCIs.

This isn’t use-it-or-lose-it coverage. With traditional LTCI, you pay premiums for years, usually decades. If you don’t need LTC or only need a small amount during your lifetime, the only benefit you receive is peace of mind from knowing the policy was there if required. There’s no cash value account or refund of any of your premiums. With the Leveraged Care options, you or your beneficiaries always get your premium back in benefits or a return of that premium.Your cost is locked in for the life of the policy.Your savings are leveraged. The amount you have available to pay for LTC usually is three to 10 times your premiums.

There are many variations of Asset-Based or Leveraged LTC plans. The one I really like is known as the Return of Premium Long-Term Care plan or ROP LTC. The foundation is a universal life insurance policy with a long-term care benefit.

Your amount of LTC coverage is determined by your age, the amount you deposit, how long you own the policy before you claim LTC benefits and a couple of other factors.

You choose your level of inflation protection from 0%, 3%, or 5%, and at either a simple rate or compound rate. The 5% compound inflation rate provides you the most protection but also decreases your initial coverage the most.

You also select the number of months over which benefits will be paid when needed, up to 84 months. Most people select 72 months. The number of months selected influences the amount of each monthly payment.

There’s no medical exam. You answer some questions about your medical history and take a cognitive impairment test, which all can be done over the telephone.You or your beneficiaries, at a minimum, receive all the premiums you paid in the form of benefit claims, a refund or a death benefit on the policy. The death benefit could exceed the premiums you paid. You can receive a refund of 100% of your premiums by canceling the policy no sooner than five years after owning the policy or at the end of your funding period.

Most asset-based plans require premiums to be deposited in a lump sum, usually of $50,000 or more. For a number of reasons, many people can’t or don’t want to make that one big payment. The ROP LTC plan allows you to make deposits over a period of one, five, seven, 10 or 15 years. You only need to deposit enough to produce at least a $50,000 life insurance benefit. The amount will depend on your age and other factors.

Periodic payments give you less coverage for the dollar than a lump sum premium does. But the initial coverage amount takes effect immediately and increases with your selected inflation rate.

Another advantage is that the ROP LTC is an indemnity policy.

There are two broad types of LTCI policies. Most traditional LTCI policies and some asset-based policies are reimbursement policies. Once coverage is triggered, you have to incur the LTC expenses and submit proof of them to the insurer for reimbursement. You wait to receive your check. There also are likely to be questions about whether particular expenses are covered by the policy.

In an indemnity policy, you qualify for a monthly benefit amount. When coverage is triggered, you receive the monthly amount. With the ROP LTC policy, you pay for the first 90 days of coverage, and then the monthly benefits begin.

You can use the monthly benefits however you want. You can pay friends or relatives to provide your care at home. Or you can have professional home care. You also can go to an assisted living facility or a nursing home. If the cost of your care is less than the monthly benefit, you can save the excess or use it to pay for other expenses.

As with other LTCI policies, your benefit is triggered when a doctor certifies that you need help with at least two of the six activities of daily living or have cognitive impairment. You don’t have to enter a nursing home or have a previous hospital stay. The LTC benefits are tax free.

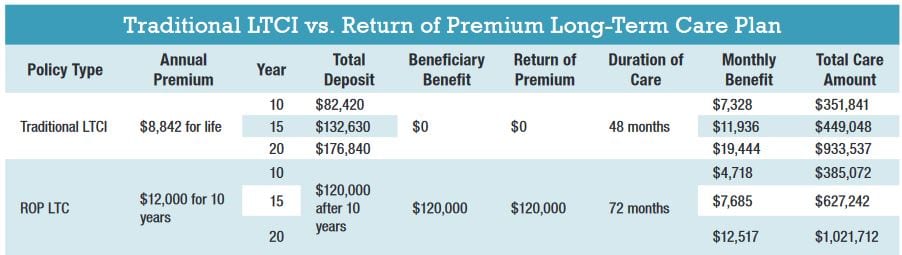

The table compares the ROP LTC plan to traditional LTCI for a male age 65 who selects 5% compound inflation protection and a 90-day waiting period on each pol-icy. The cost of the ROP LTC is guaran-teed not to increase while premiums on traditional LTCI can increase. This specific ROP LTC policy is available to people ages 40 to 75, while other plans are available up to age 80.

The policy is ideal for people who have money in safe, low-yielding investments held primarily for future LTC or other emergencies. By repositioning some of the money in the ROP LTC policy, you immediately leverage those funds. The policy increases the amount of money available for LTC by a minimum of three times your premium and up to 10 times, depending on the inflation rider.

I was alerted to ROP LTC by David and Todd Phillips of Phillips Financial Services, my go-to sources for the best in life insurance, LTCI and annuities.

They have a digital report with more details, The Return of Premium LTC, that they are offering to my subscribers at no cost. For more information about this and other LTCI options, contact them at 1-888-892-1102 or https://ltc.epmez.com/ropltc1/.

![]()