How to Re-Balance Your Portfolio

You can have a leg up on most investors, including those who are supposedly the most sophisticated.

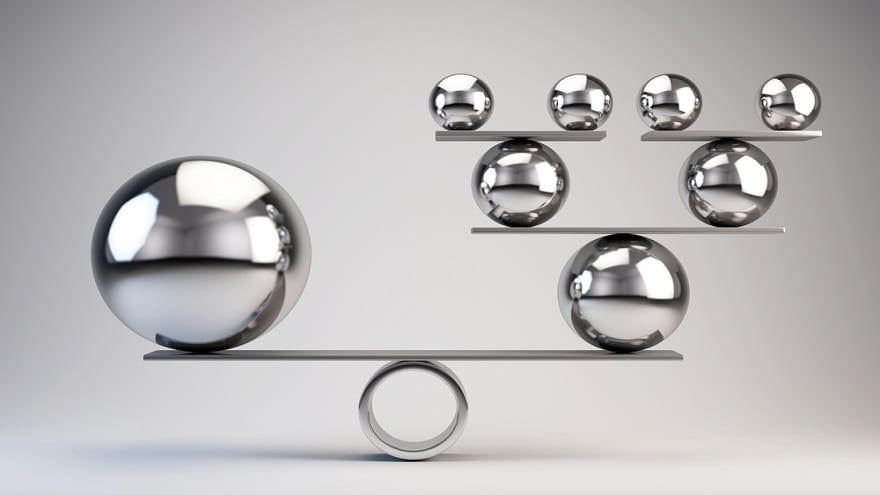

Most investors, even the largest pension funds, neglect to rebalance their portfolios. Yet, rebalancing is an excellent way to improve long-term returns and reduce risk. It is especially valuable with long-term holdings such as a Core Portfolio.

If you started with 60 percent stocks and 40 percent bonds a year ago, market changes likely moved you to 50 percent stocks and 50 percent bonds today. You rebalance by reducing the bonds and increasing the stocks so your original 60-40 ratio is restored.

Rebalancing is a great way to sell high and buy low. You don’t even have to know anything about the markets.

Make rebalancing an automatic process, but don’t rebalance too often. You want to let a winner run for a while. Some people rebalance by the calendar, doing it once or more often each year. The policy with the best results probably is to rebalance when a fund is more than five percent off its target.

Adopt a rebalancing policy and stick with it. Your returns will increase and risk will be reduced.

There are no recommended changes in the Core Portfolios. Let’s take a look at the Managed Portfolios.

Sector Portfolio

It’s been a wild ride in the markets the last month, but this portfolio has been fairly stable. Expect its balance and diversification to continue giving you a rather smooth ride while investors sort out the economy and geopolitics. I like the positions for the coming months and recommend holding them. I’ve removed sell signals from the less volatile funds but encourage you to keep an eye on the more volatile funds with sell signals listed on page 10.

Last month we added three funds. TCW Galileo Select Equity is an aggressive growth fund with an outstanding history under manager Glen Bickerstaff. The fund has a knack for finding some of the fastest growing companies around. Since the latest market bottom in February, this fund has generated outstanding returns. (See the rankings on page 11.) In a rising market, this fund will continue to return much more than the indexes.

Should the market indexes begin another decline, this fund is likely to decline more than the indexes, so keep an eye on the sell signal. Because the market is likely to be volatile, I’m giving the fund a lot of room before the sell signal is triggered.

We also added two ‘hedge funds” to the portfolio last month: AXA Rosenberg Global Long/Short Equity and Hussman Strategic Growth. They have different strategies with the same goal. They smooth out the market’s volatility and try to earn a solid return in any market environment. They do this by buying attractively priced stocks and selling short either expensive stocks or a market index. Each managed to earn solid profits in the bear market and has maintained a fairly stable value during the recent wild market swings.

Don’t expect big price moves in these two funds, and at times they will move contrary to the indexes.

These three funds complement each other very well. Because of the stability of the AXA Rosenberg and Hussman funds, I’m removing their sell signals. I believe these funds should be ideal for this market environment and should be allowed to let their strategies work.

Rounding out the portfolio is a selection of income-oriented funds. Price High Yield has been a market leader for the last month as investors become more optimistic about the economy. (See the rankings on page 11.) Dodge & Cox Income has done well for the same reason.

Cohen & Steers Realty Shares has been an oasis of stability during the bear market. As the economy improves, this fund also should resume its growth path and return 8% or more per year with little downside risk.

American Century International Bond is our hedge against a falling dollar. This has been a profitable investment for most of the past year but has lost ground in recent months from its high of $12.99. Because geopolitical news is likely to cause big, short-term swings in the dollar, I put a low sell signal on this fund. Keep an eye on the fund’s price in case there is an extended rally in the dollar.

Balanced Portfolio

This portfolio holds the same funds as the Sector Portfolio but in different allocations. Hold all the current positions and review my comments on the Sector Portfolio.

Income Growth

The markets are in the sweet spot for this portfolio’s trove of investments that both pay high income and have the potential for capital gains.

Corporate bonds through Price High Yield and Dodge & Cox Income anchor these portfolio. As treasury bond yields declined, investors sought other sources of income. In addition, while the economy is not on a roaring growth path it isn’t likely to slide into another recession. That gives investors more confidence in corporate bonds than they had a year ago. PIMCO Total Return also is partly invested in corporate bonds. Cohen & Steers Realty Shares regained investor confidence after the economy appeared unlikely to slide into a second recession.

As in the other portfolios, one fund to watch is American Century International Bond. If the dollar begins an extended rally, this fund will fall through its sell signal and must be sold.

Income

Our nimble move out of interest-rate sensitive investments a few months ago is paying off. Corporate bonds have generated capital gains while paying high yields. Straight treasuries and mortgages such as GNMAs have not done as well. Interest rates are at or near their lows for this cycle, and rising rates will hurt the treasuries and mortgages. Rising rates might be a reason to sell PIMCO Total Return from the Managed Portfolio in coming months. For now, stick with the current positions, but keep an eye on the sell signal for American Century International Bond. We’ll enjoy some capital gains and continue to earn the high income of this portfolio.

As always, details of the portfolio recommendations, including buy and sell prices are on page 10.

![]()