How to Slash Your Out-of-Pocket Retirement Medical Costs

Covering the gaps in original Medicare coverage is critical to maintaining your financial security in retirement, and there are some important changes coming in 2020.Many medical expenses aren’t covered by original Medicare, as I’ve discussed in the past, including the September 2019 issue.

When you choose original Medicare instead of a Medicare Advantage plan, decide which coverage gaps you’ll cover from income and investment assets and which will be covered by additional insurance.

The largest gap in original Medicare is the Part B 20% copayment of covered care. Even when care is covered by Part B, Medicare usually pays only 80% of the cost. You’re on the hook for the other 20%, without limit, unless you have other coverage. There also are other co-payments, coinsurance and deductibles in original Medicare Part B. Plus, some care isn’t covered by original Medicare, such as medical care received outside the United States.

The best way to cover gaps in original Medicare is to buy a Medicare supplement (or Medigap) policy. These policies are sold by private insurance companies but are regulated by Medicare. To purchase a Medigap policy, you must have Medicare Parts A and B and not be enrolled in a Medicare Advantage plan. (A Medigap policy will not cover prescription drugs. For prescription drug coverage, you also need a Part D Prescription Drug policy, which I discuss in a separate article this month.) In most areas, you have a choice of Medigap policies from different insurers.

A Medicare supplement policy covers only one person. If you’re married, each spouse needs a separate policy.

When you’re first eligible for Medicare, insurers must sell you a Medicare supple-mental policy if you want one regardless of your health history. Once you buy a Medigap policy, it is guaranteed renew-able, as long as you want it regardless of changes in your health.

You can switch Medigap policies any time during the year, but it’s a good idea to always review your options during Open Enrollment each year (Oct. 15 – Dec. 7) when you may change your other coverage. When you seek to switch Medigap policies after your initial enrollment period, insurers can use your health history to deny coverage or to charge you a higher premium. They also can decline to cover expenses from a preexisting condition for a period of time.

There are some exceptions to these rules. For example, if you were covered by a group employer or union plan at age 65, you might qualify for guaranteed issue of a Medigap policy after age 65. In general, though, it’s best to buy a Medigap policy during the six-month period that begins when you turn age 65 and are first enrolled in Part B.

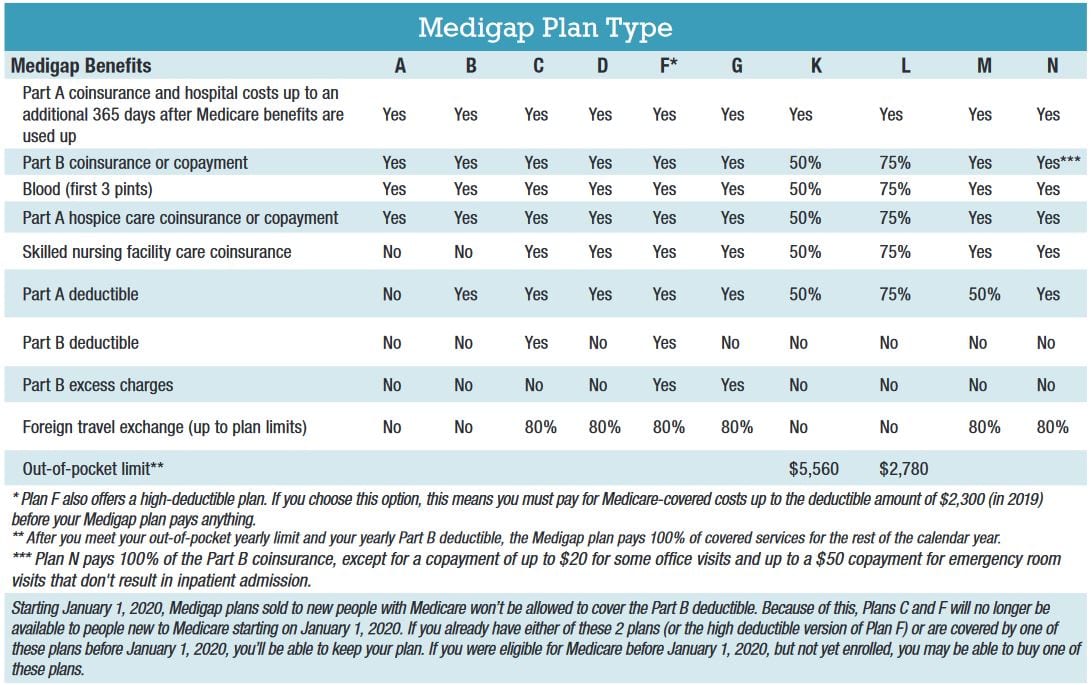

There are 10 standardized Medigap policies with different levels of benefits. An insurer can offer only these types of policies, but it doesn’t have to offer all of them. The chart shows the different policies and the basic benefits each offers. (The policies are standardized differently in Massachusetts, Minnesota and Wisconsin.)

Historically, Plan F offered the broadest coverage. If you could afford the premiums and wanted to reduce uncertainty concerning your out-of-pocket medical expenses, that was the plan to choose.

Plan F, however, won’t be available beginning January 1, 2020. The law was changed so that no plan will be allowed to cover the Part B deductible. That means Plans C and F no longer will be available.

If you have a Plan C or F policy, you’ll be allowed to renew it each year if the insurer offers it. Not all insurers plan to continue issuing these policies. Keep in mind, however, that as the number of people owning that policy becomes smaller and older, the policy might become more expensive.

The most comprehensive Medigap policy available to new buyers in 2020 will be Plan G. Beginning in 2020, there also will be high-deductible version available. The best alternative to Plan C will be Plan D. Once you decide on the type of policy you want, be sure to shop around.

This is a very important step, because premiums vary considerably among insurers though the policies are standardized. Studies show that people regularly pay premiums that are 100% or more higher than they could have paid on an identical policy.

Weiss Medigap tracks Medigap policies and compares them. Here are a few examples of pricing differences for 2019 from Weiss Ratings.

- In Colorado, a 65-year-old male seeking a Plan F policy could be charged an annual premium of $5,424 from one insurer or $1,543.68 per year from another insurer.

- In Illinois, a 65-year-old female looking for a Plan N policy could pay $3,947.52 from one insurer or $878 from another insurer.

- In Pennsylvania, a 75-year-old male shopping for a Plan G policy could pay $6,129.36 to one insurer or $1,721.29 to another insurer.

The 2020 policies and premiums will be issued shortly, in time for Open Enrollment.

There are different ways to shop around. The Medicare website will list all the policies available in your area with the basic details and premiums. It will provide links to the insurers’ websites where you can examine details. You also can call 800-MEDICARE and discuss your alternatives over the telephone. Your local area resources on aging usually provides free counseling to those examining their Medicare options.

In most areas, you can find insurance agents and financial planners who have specialties in Medicare and will discuss the different options with you.

You also can receive a personalized guide at www.WeissMedigap.com. With-in a few minutes of entering your data, the website generates a report showing every available provider in your area and the monthly and annual premiums. The report also includes the Weiss Safety Rating for each insurer, which evaluates their financial stability. Weiss Medigap is not affiliated with any insurer and doesn’t receive compensation from insurers or agents.

![]()

Related Posts:

- Cut Your Prescription Medicine Out-of-Pocket Costs

- Don’t Be Scared By Those Estimates of Retirement Medical Spending

- Warning: Your Children May Have To Pay for Your Long-Term Care

- You Need to Get Medicare Prescription Drug Coverage Right This Year

- Act Now to Avoid Higher Medicare Premiums in Two Years