The New Rules

Of Retirement

Whether you are 40 or 80, forget everything you’ve heard about retirement. It’s all changed and will change again. I can show you how to stay on top of the changes and use them to create the retirement you desire.

Dear Friend,

Your job is harder than ever.

Forces are at work threatening your plans to establish and maintain lifetime income security. I’ve been monitoring the threats to building a reliable retirement income stream for more than 30 years, and I’ve never seen a situation as dangerous as today’s.

Many retirees and near-retirees are being set up for a rude surprise by trends that are gathering strength. Investors, especially IRA owners, are facing unprecedented threats to their financial freedom and independence.

Keep my principal secure.

Pay me income.

Protect me from inflation.

Those are the goals of more and more investors. As the Baby Boomers approach their post-career years, they focus on preserving their hard-earned nest eggs and receiving steady cash flow from their portfolios. They want to ensure they’ll have enough income and assets to meet their lifetime goals.

Steady, secure income means financial independence.

That’s why, as the Boomers age, interest in developing a continuing, stable stream of cash is, well, booming.

Unfortunately, the third decade of the 21st century is the most challenging time to try to meet these goals. Not too many years ago, it was easy to convert a pre-retirement portfolio into a reliable stream of cash flow that replaces your working years’ income.

It was so easy, the financial services profession didn’t put much research and work into retirement income management. Only a few of us focused on issues such as how to plan withdrawals from IRAs, reduce taxes on retirement income, and most efficiently include annuities in a retirement portfolio.

Now, income security is a prime concern, and the Baby Boomers and their financial professionals are struggling to catch up.

Tough decisions need to be made about IRAs, 401(k)s, medical insurance, investments, taxes, estate planning, and more. Many of the decisions are irreversible.

Make the wrong choice, and the rest of your retirement plan might not matter.

More importantly, changes are taking place in the economy, the markets, government policies, and employer practices.

Interest rates set by the Federal Reserve are still well below the long-term averages.

Many government programs are in poor financial shape.

Employers continue to slash benefits.

The strong bull market that began in March 2009 probably means returns will be below-average in the future.

That’s why more and more people believe war is being waged on retirees and those planning for retirement.

In 1989, only 30% of Americans ages 30 and older were financially unprepared for retirement, according to the Center for Retirement Research. In 2021, CRR estimated 52% of Americans over 30 are likely to fall short.

About two-thirds of those aged 45 to 60 say they will retire later than they had planned, according to the Conference Board. In 2011, that number was only 42%.

Government data show that after many decades of declining, the average retirement age has been increasing. Even those who think they’re prepared for retirement often aren’t.

Almost half of all Americans die with financial assets of less than $10,000, according to recent research by James Poterba, an MIT economist.

Many Americans enter retirement with what seemed to be a substantial amount of financial assets, but because of mistakes and unforeseen events, they spend faster than they anticipated and end up with few assets.

It doesn’t have to be that way for you.

You can be financially secure during your post-career years, free of the worries that will plague many others in the coming years.

But you can’t rely on what worked in the past. Following tired “rules of thumb” and traditional cookie-cutter approaches is the road to income insecurity.

Don’t travel that road.

You can find plenty of retirement advice online, in books and magazines, and other places. But you’ll find mostly a rehash of the old rules of retirement.

More importantly, many of the real questions you face won’t be addressed, and there won’t be updates as the rules of retirement change.

You need to use strategies and tools that are different from those that worked for past generations of retirees. Retirement has changed and will change again.

The markets and economy, tax law, estate planning, health insurance, Medicare, Social Security, long-term care, annuities, and all the other financial aspects of your post-career life are being transformed.

You need to be on top of the changes and know how they’ll affect you.

Assessing the Six Threats to Lifetime Income Security

Most importantly, you need to know how to deal with today’s six threats to lifetime income security. Most of the threats aren’t new, but they’ve been growing rapidly, and the danger to your security is increasing.

RETIREMENT RISK #1

The foundations are crumbling.

For decades, Social Security and Medicare provided the secure financial foundation of retirement. Today, those programs are in financial trouble and will have to change in the future.

You know about Social Security’s problems. If changes aren’t made by 2034, a 23% cut in benefits will be required to maintain the system, according to its chief actuary.

Many people say they don’t expect to receive anything from Social Security and aren’t including it in their plans. But they underestimate the importance of Social Security to retirees.

Even for higher-income people who earned at least the maximum Social Security wage base for 35 years, the program replaces 28% of pre-retirement income. For low income beneficiaries, it replaces 90% of pre-retirement income.

Most current retirees report depending more and more on Social Security as the years go on. If the program goes under or benefits are reduced substantially, you’ll have to make major adjustments.

Medicare is in even worse shape and is closer to insolvency. Without change, Medicare will be bankrupt by 2022, according to the Congressional Budget Office.

There are likely to be higher premiums, reduced benefits, more means-testing, and a later eligibility age.

Like it or not, Social Security and Medicare are the foundations of the American retirement, and you’ll have a tough time replacing them.

That’s why in a few minutes I’ll show you how to shore up these foundations of your retirement plan. You’ll learn to maximize the benefits you receive from these programs and avoid making the mistakes that thousands of retirees make every year.

Learn the facts, and Social Security and Medicare can be valuable assets, effectively adding many thousands of dollars to your nest egg.

RETIREMENT RISK #2

You’re on your own for medical care.

Retirement medical and long-term care costs are prime worries of most Americans. About 67% of Americans ages 55 to 65 said medical expenses were the top retirement concern, according to a survey by Allianz. And rightly so. They are the retirement plan wild card.

I’ve learned that medical expenses and health care are the most misunderstood and underestimated expense for retirees. Consider this:

- Many Americans believe that Medicare or their employer’s insurance will cover most retirement medical expenses and long term care expenses they need. That’s not even close to the truth.

- Only 28% of employers with more than 200 employees provide retiree medical coverage (compared to 66% in 1968). Most of those that still provide coverage are reducing benefits and moving retirees to privately run insurance exchanges.

- EBRI estimates that Medicare covers about 62% of medical costs for beneficiaries. Plus, there are many medical expenses that aren’t covered by Medicare. You need a way to pay for all of those.

- Medicare covers only about half of the average member’s medical expenses. The average retiree will pay $6,000 to $8,000 out-of-pocket each year for medical care. That’s the average, so many pay more and some pay considerably more.

- Annual studies from the Employee Benefits Research Institute and Fidelity Investments regularly conclude that couples retiring at age 65 will need $300,000 or more to pay for out-of-pocket medical expenses during the next 30 years.

- Long-term care expenses generally aren’t covered by Medicare. The truth is, Medicare pays for only a minority of nursing home expenses, and those payments largely are for short-term rehabilitation after an illness or injury. Residents and their families pay most nursing home expenses.

- Prescription drugs aren’t covered by basic Medicare Parts A and B.

- Medicare now is means-tested. The higher your income is, the higher your Medicare premiums will be for both regular Medicare Part B and for prescription drug coverage under Part D.

The Affordable Care Act shifts money away from Medicare, especially the popular Medicare Advantage program, reducing benefits and increasing costs for beneficiaries.

“I have been a subscriber to Retirement Watch since 1997. I trust Bob Carlson completely and follow his investment, tax, and planning advice personally.”

Medical expenses will be one of the three biggest post-career expenses for most people, and they’ll only increase as the years go on.

Even those who understand they are largely on their own for medical care need to know more. Many pay far too much for Medigap, Part D prescription drugs, and long-term care coverage.

Recent surveys found that many owners of these policies pay up to twice what they need to. It doesn’t do much good to save and invest for a comfortable retirement and build a legacy for your loved ones only to spend most of your nest egg on medical care and overpriced insurance.

That’s why I keep my readers up-to-date on the truth about Medicare, Part D prescription drug coverage, long-term care and every other aspect of paying for their medical care.

RETIREMENT RISK #3

Avoid the #1 retirement planning mistake.

“We didn’t realize how much everything would cost, Bob. That’s the mistake we made.”

Those were the words of a woman who shared, with her husband, a large lakefront house (with an indoor swimming pool) in a secured golf course community in central Virginia. They also owned a condo in Florida to be near their grandchildren in winter.

They weren’t hurting for money. But after five years of retirement, the couple was concerned that they had underestimated the cost of retirement. He went back to consulting part time, and she also found part time work.

“Thanks to Retirement Watch, we always seem to have money to spend on things we want and need.”

This is not unusual. Ask many retirees what their biggest retirement planning mistake was, and a high percentage will say that they didn’t do a good enough job of estimating retirement spending.

Ask financial professionals, and they’ll also say that most people don’t have a good handle on how much retirement costs.

One-third of U.S. adults who haven’t retired say they’ll need 25% to 50% of their pre-retirement income in retirement, while another third say they’ll need 50% to 75%, according to a recent TIAA-CREF survey.

The traditional rule of financial advisors is your annual retirement spending will be 65% to 80% of your pre-retirement income. But which is it? 65%? 80%? Or something in between?

The assumption is that you’ll spend less in retirement because you won’t pay Social Security taxes or have work-related expenses. But this simple rule of thumb, one of the great myths of retirement, gets many people into trouble.

You will spend less in retirement on expenses such as commuting, new work clothes, payroll taxes, 401(k) contributions, and a few other items. It sounds very logical.

But since you aren’t working, you have time to fill.

That time might be filled by activities that cost money, such as golf, travel, entertaining, eating out more, going to more shows or movies, hobbies, spoiling the grandchildren, or a host of other possibilities.

Over time, you also are likely to incur higher medical expenses.

With parents living longer and children needing more financial help, you could end up helping both your parents and your children. That situation will become more and more common.

The truth is that for many people, expenses stay the same or increase in the first years of retirement. The money just goes to different expenses.

A rule of thumb that actually works is that the higher your income, the less your expenses are likely to decline in retirement.

If you don’t want to wake up in a cold sweat worrying about money a few years into retirement, ignore the general rule. The question is: How much are you likely to spend in retirement?

Many people learn to their regret that their spending won’t decline in retirement. Even those who correctly estimate their retirement spending often make a different mistake.

“The best, most useful financial advice newsletter that I get.”

In fact, the most common retirement planning mistake is failing to consider inflation in retirement plans. Many people develop a spending plan for the first year or two of retirement that matches their income. But they forget that prices and costs change over time.

Inflation is one of the great enemies of retirees. The average 3% annual inflation of the past few decades cuts your purchasing power in half over 24 years and by close to 20% after five years.

The recent 8.5% inflation cuts your standard of living by over 50% after 10 years. It doesn’t happen overnight, but it is very painful over time.

You can learn the right way to estimate your retirement expenses, the true effects of inflation, and more. Keep reading to see how to make your money last.

RETIREMENT RISK #4

Most retirement investment advice is wrong and dangerous.

Retirees and those close to retirement get the worst investment advice. And it’s gotten worse over the years. That’s not surprising.

Financial advisors and brokers concentrate on investors who are going to increase their investment accounts each year. That’s a growth business.

There’s not much growth when clients plan to spend their investment funds and draw down their accounts.

The investment advice for retirees used to be simple.

As you get older, move most of your portfolio out of risky stocks and into safe, income-producing investments such as bonds, certificates of deposit, and money market funds.

“Your information on annuities stopped me from making a huge mistake.”

That made sense when retirement lasted about five years, interest rates were higher, and you didn’t have to worry about wide changes in the cost of living.

Now, this advice is the most dangerous thing you can do in retirement. More recently, retirees and pre-retirees were told to invest like everyone else, using diversified portfolios developed using historic returns and computer programs.

They were told to buy-and-hold these portfolios and to count on the long-term trends of ever-rising stock prices. While the strategy can work over the very long run, unfortunately it often produces poor results in the short run.

People in or near retirement can’t invest based on 80 years of history. What happens in the next 10 years or so is what matters to them. Results over the next 10 years often vary greatly from the last 10 years and the historic average.

It’s risky advice when the next 10 years of returns will make or break your retirement plan. The dirty little secret of traditional investing is that, while people are told they have diversified portfolios, they really don’t.

The truth is that when a portfolio is 60% stocks and 40% bonds, about 90% of your total returns and volatility are tied to the stock indexes.

Your retirement security rises and falls with the stock indexes. When the bulls are running, that’s a great thing. But the volatility and huge market declines like we had since 2007 and again in 2020 hurt many retirees and put future retirees in uncomfortable positions.

These days, investing conservatively and for safety isn’t rewarding either. Interest rates are well below what investors need to generate decent income. The Federal Reserve’s low interest rate policies might have saved the economy, but they punish savers who simply want a comfortable, safe retirement income.

It doesn’t have to be that way. You can earn higher returns than you have recently while taking much less risk. You don’t have to bounce up and down with the stock indexes or sit in cash, losing money to inflation and taxes.

In Retirement Watch, I develop strategies that actually help Americans who are planning for retirement or are in retirement.

I’ll tell you more about those strategies in a few minutes.

RETIREMENT RISK #5

Retirement lasts longer than most think.

For the first generation of post-World War II retirees, retirement generally lasted five years or so. Today, many people still believe they have to plan only for five to 10 years of retirement.

The fact is, a twenty- year retirement is common, and thirty-year retirements aren’t unusual.

People on average retire before age 65. Though many people now say they plan to work longer, about half of people retire involuntarily and before they expected.

Some people retire because of medical problems or injuries from accidents. Others lose their jobs due to restructuring or a layoff and can’t find suitable new jobs, so they retire.

The fact is that retirement could last a long time, even if you plan to continue working, because you might not retire when you thought.

Even for those who retire at age 65 or later, retirement can last a long time. People simply are living longer than they used to.

Here’s a sample of what you need to know about longevity. In a married couple in which each spouse is age 65 today, there’s about a 20% chance either spouse will live to 95. When both spouses are 55, there’s a 43% chance at least one will live past 95, according to annuity mortality tables. In about 15 years, the odds will be about 50%, according to the insurance actuaries.

Many people born in 1946 and later can expect to spend more than 30 years in retirement. Some will spend more time in retirement than they did in their careers.

There’s another twist to consider. Most of my readers are wealthier and better educated than the average person.

They have access to better medical care. They’re more likely to make smart lifestyle choices. They generally had careers that weren’t physically demanding and were unlikely to result in injuries or disability.

These factors make an above average life expectancy more likely.

If you’re reading this you’re likely to live four or more years longer than the average for your age. And lifespans are likely to increase in coming years as science discovers new treatments and cures. There are many benefits to longevity and longer lifespans.

But there’s one giant negative. The nest egg needed to pay for all those years of retirement can be substantial.

You have to save enough money and keep that nest egg growing to pay for all those years of retirement and protect your purchasing power from decades of inflation.

RETIREMENT RISK #6

Your taxes won’t go down in retirement.

Your taxes will be lower in retirement. That used to be true. Now it is one of the most dangerous myths in retirement planning. Instead, you have to protect yourself from the retiree tax attack.

Even after the Tax Cuts and Jobs Act of 2017, taxes are going to be one of your three largest expenses in retirement. Despite the income tax rate cuts, your taxes are likely to increase during retirement.

For years, Congress and the IRS quietly looked to older Americans to increase government revenues. After all, older Americans are the richest generation in history. You don’t think you’re rich, but Congress does. And state and local governments also are desperate for cash and have been raising taxes.

One of Congress’ favorite tricks is to sneak in a bunch of what I call Stealth Taxes that mostly affect those in or near retirement age.

Some of the Stealth Taxes were repealed in the 2017 law, but others remain, such as the tax on Social Security benefits, the Medicare premium surtax, the Alternative Minimum Tax, the 3.8% net investment income tax, and more.

The new law also was a stealth tax increase for some.

Sure, income tax rates are lower. But personal exemptions are eliminated as are a number of itemized expense deductions, especially deductions related to investments and taxes.

Other deductions are limited, such as the deductions for mortgage interest and state and local taxes. Even after taking the higher standard deduction into account, some taxpayers could pay more if they don’t take action.

Plus, those lower tax rates and most of the other benefits for individuals in the new law are temporary. They’re scheduled to disappear after 2025, and they could be repealed earlier by a new Congress.

Even after the 2017 changes, it’s not unusual for taxes and tax rates to stay the same or even increase after retiring. In fact, because of the Stealth Taxes, retirees face some of the highest marginal tax rates in history.

Here’s an example. Social Security benefits used to be 100% tax-free. But in 1993, the law was changed.

Now, if a couple’s income is greater than $44,000 ($34,000 for single taxpayers), up to 85% of Social Security benefits are taxed. So, if you earn $1 more from your investments — or are forced to withdraw $1 more from an IRA after age 72 —pushing your income above $44,000, not only is that extra dollar taxed, but up to 85% of Social Security benefits are taxed.

“Most of the tax and estate changes that affect me are covered in your publication before I see them anywhere else.”

Your marginal tax rate could skyrocket if you live in a state with a high tax rate.

And what’s worse, the $44,000 income level threshold is NOT tied to inflation. More people are hit with this tax each year, and the 2017 tax law didn’t change it at all.

You have to be on constant guard against politicians devising new and creative ways to get their hands on your nest egg. It’s only going to get worse now that the Baby Boomers are surging to retirement age.

Consider these provisions that were popular in Congress but weren’t included in the final tax reform law:

- Reducing the maximum contributions to retirement accounts, including IRAs and 401(k)s;

- Turning all retirement accounts into Roth accounts, disallowing any tax benefits for contributions;

- Taxing long-term capital gains and qualified dividends at the same rate as other income

- Disallowing all deductions on vacation homes and second homes;

- Requiring investors to use their lowest tax basis, effectively increasing capital gains taxes on the sales of stocks and mutual funds

Make no mistake, these would be heavy taxes on retirees and many in Congress want to turn to retirees to help pay the government debt.

Keep reading, and I’ll show you how to beat the retiree tax trap and the other threats to your lifetime income security.

You Can Create Safe, Secure, Sustainable Lifetime Income

You don’t have to stand there meekly and let these risks destroy your nest egg.

You can fight and win.

I know. I identified the threats a long time ago and have helped tens of thousands of investors just like you overcome them and establish lifetime financial security.

You can build a fortress around your assets and generate reliable cash flow. I believe today is a great opportunity for those who prepare and adapt.

Through solid, independent research and advice, I discovered the critical strategies needed to establish and maintain financial security.

To be clear, I’m not offering a magic formula, silver bullet, or single ideal investment. You won’t see me talking about some obscure or secret government plan and promise it will make these obstacles go away.

I’m not telling you there’s an investment vehicle that was created by a law that was known only by a few insiders until now.

You’ll have to look elsewhere for such gimmicks and fads.

I offer a toolbox of strategies and a solid plan that will help create the retirement you desire. I will urge you to ignore the status quo, conventional rules of thumb, and standard Wall Street advice.

My plan isn’t complicated, either. I find that simple solutions often are the best.

Through relentless, detailed, independent research I push past the complexity so beloved by Wall Street and Washington and guide my readers to strategies that will maximize their cash flow.

My plan also is comprehensive.

I help readers make the right moves on tough issues involving all the financial aspects of retirement planning: Their investments, Social Security, managing IRAs, pension plans, annuities, estate planning, medical coverage, income taxes, and more.

Most importantly, I’ve learned, and my readers know, that a retirement plan is a process, not an event.

As you’ve seen, the rules and circumstances keep changing. You can’t set-it-and-forget-it. For 30 years I’ve kept my readers a step or two ahead of those changes, exploded myths, and steered them down the road to financial security.

I write the only publication devoted to all the financial aspects of retirement. Most “retirement” publications focus on finding the highest yields, hot investment tips, the best places to retire, or a few other topics.

That’s not for us. To have a successful retirement, you need to fit together all the pieces of the puzzle.

Let me keep you on the road to retirement security. Let me explode some retirement myths and explain to you some of the key New Rules of Retirement.

Think about my suggestions for improving your retirement. Take notes. Review my ideas.

Then, consider my invitation to join our growing family of Retirement Watch members.

Now is the best time to begin your membership.

Please keep reading, and let me show you how to create the retirement you desire. You’ll learn the basic elements of my plan and how you can obtain all the details.

RETIREMENT RULE #1

Defuse the Ticking Time Bomb in Your IRAs.

IRAs are the most valuable assets most people own. With the demise of employer-guaranteed pension annuities, the key to financial security is making those IRAs and 401(k)s last beyond a lifetime.

Yet, your IRA isn’t as valuable as you think. IRAs and 401(k) accounts essentially come with mortgages on them.

You see, traditional IRAs and 401(k)s have a lot of tax breaks on the front end. You might have deducted the IRA contributions or excluded the 401(k) contributions from income. Over the years those contributions were invested, and the gains and income compounded free of income taxes.

When you withdraw the money and want to spend it, however, it’s taxed, and it’s taxed as ordinary income. You lose the tax advantages of any long term capital gains or qualified dividends earned in the account.

Those are the costs of tax deferral and the mortgage on your IRA. IRA distributions will be taxed along with the rest of your income, so you could be paying a tax rate as high as 35% on some of the distributions, plus any state income taxes.

The real value of your IRA isn’t the amount listed on your statements.

The real value is the account’s market value minus the taxes that will be due on the distributions. You spend only the after-tax value, while the IRS gets the rest.

That’s just one of the reasons that managing your IRA in today’s more complex world is tricky. Things change. The law. The economy. The markets. The trends.

You need to know how to make IRAs last. I’ve studied and researched in great detail how to stretch an IRA. I’ve learned that a few simple, but often overlooked, steps can ensure your nest egg churns out distributions longer. Years longer.

Few people even consider some of the key questions of IRA management. Many of those who do consider the questions seek answers in some widely held rules of thumb.

These rules sometimes work, but many of them are out-of-date or aren’t best for every situation.

My readers know the key answers to these issues:

- Which investments should be held in IRAs and which in taxable accounts? Here’s a clue: The answer isn’t the same for every investor.

- Which accounts should you draw down first in retirement? Taxable accounts? IRAs? Roth IRAs? Should you draw from each of them every year? Does it matter?

- What’s the one investment you should always sell first when you start tapping your nest egg?

- How do you determine the best investment to sell for the lowest possible tax bill?

- Three little-known ways to outfox the tax man when trading stocks in your taxable investment accounts.

- The one and only time it makes sense to hold stocks in an IRA instead of a taxable account.

- The type of retirement account you should almost always tap last — even though most people don’t. Don’t let this common mistake put your long term retirement security at risk.

You can see how making a few smart asset allocation decisions in your taxable and non-taxable accounts could save you thousands of dollars in needless taxes. These dollars could add up to lots of extra dough for you and your loved ones to enjoy.

My readers also know:

- How to safely add gold, silver, and other hard assets to your traditional IRA — without setting up an expensive Self-Directed IRA. You won’t believe how easy it is to do.

- How the same spending strategy used by Yale University can help safeguard your IRA. This proven system is used to protect Yale’s multi-billion dollar endowment fund against inevitable market downturns — and it can do the same for your portfolio, too.

- How to buy your dream vacation home using your IRA. Do it this way and you won’t have to worry about any backlash from the IRS.

- Want to convert multiple IRAs into one Roth IRA? No problem. Follow these four easy steps to convert one or more IRAs or just part of an IRA into a Roth IRA.

- How to take your required minimum distribution without liquidating a single share of stock or other investments you own in your traditional IRA.

- The common withdrawal mistake that makes your Roth IRA vulnerable to a massive IRS tax grab. These two simple steps let you tell the taxman to take a hike.

- Have a 401(k)? When it makes sense to convert it to a Roth — and when it doesn’t. Get the full scoop on whether this little-known tax-saving strategy will work for you.

I give Retirement Watch readers all the details on these and other savvy ways to manage your IRA and other retirement accounts.

You’ll find many of these insights in my Special Report, The New Rules of Retirement. This report is available to you free when you become a member of Retirement Watch.

RETIREMENT RULE #2

Stop Following Tired, Failed Investment Advice.

Investors don’t have to struggle the way most have since 2000 and are likely to in coming years. They don’t have to be subject to extreme market volatility or a long-term bear market in stocks.

It just doesn’t have to be that way.

But you can’t profit by using leftover strategies that worked in the pre-2000 bull market or before the 2008 financial crisis.

“Bob Carlson is helping me build an income and growth portfolio. I lost a lot of money by not paying attention to Retirement Watch! I finally fired my financial advisor and am paying much more attention to Retirement Watch.”

You need other strategies to maintain your financial freedom and ride down the road of solid, steady profits. I’ve shown tens of thousands of readers strategies that work well in almost any market.

I’m a safety-first investor. I always want a margin of safety. I manage risks first and look for solid returns second.

That’s the way to earn higher long-term returns and avoid large losses. I don’t want only good returns. I want low risk.

The result is that in one of its last issues, The Hulbert Financial Digest ranked Retirement Watch as one of the top-performing newsletters in bear markets. That’s why for a long time I was ranked highly for long-term risk-adjusted returns among mutual fund newsletters by The Hulbert Financial Digest. My recommendations earned more than the S&P 500 while taking one-third less risk, according to Hulbert.

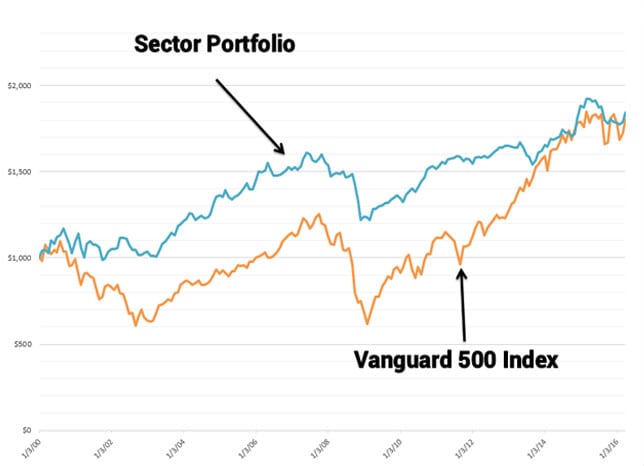

I not only have a good track record, I have a long one, as you can see from the chart.

You see, I bring to Retirement Watch readers the best strategies of the institutional investment world. I serve as Chairman of the Board of Trustees of the one of the largest local government pension funds. Its portfolio has been among the top performers in the country for the past 10 years.

In the pension fund we work with the best, most innovative firms in the investment world. I take the ideas and strategies I learn from them and adapt the strategies to the needs of my readers.

My portfolios aren’t unwieldy lists of dozens of recommendations. They’re simple and easy to follow.

Almost every investor can follow my investment advice. I know there’s no such thing as a one-size-fits-all portfolio strategy and recommendations.

That’s why I offer several strategies and tell my members which strategies are best for different types of investors. I have strategies for readers who primarily want income, those who want growth, and different combinations in between.

I give specific buy and sell advice. I continue to follow my recommendations. I let you know when it is time to sell an investment and move on to something new.

My Retirement Paycheck strategy offers above-average income (recently a 5% yield) and capital gains. I have an aggressive strategy I call Invest with the Winners that’s handily beat the market indexes for a long time.

All my investment recommendations follow the same principles. The key to long-term investment success is to avoid large losses. I look for a margin of safety in all our investments.

Risk management is the key to investment success and the bedrock of my recommendations.

You’ll learn more about my strategies for investing before and in retirement after you become a member and in the free report I send to new members, 5 Easy-Chair Portfolios to Fund Your Retirement Dreams.

RETIREMENT RULE #3

Avoid the Retiree Tax Attack.

Don’t be fooled by the lower tax rates in the Tax Cuts and Jobs Act of 2017.

The law is full of tax traps, and many of them are set for those in or near retirement age. I wrote the book on retirees and taxes — literally.

My Retirement Tax Guide was so popular it went into five editions. I’ve been trained as an attorney and accountant, and I spent about 15 years writing monthly tax newsletters for tens of thousands of subscribers. After the Tax Reform Act of 1986, I wrote 199 Loopholes That Survived Tax Reform.

Most importantly, I stay on top of the changes in the tax law and how they affect different taxpayers.

That’s why my readers know how to squeeze the maximum legal benefits from the tax code. For example, I explained to readers how they can structure their portfolios and use special tax rules to stay in the 20% (or lower) tax bracket after retirement for life, no matter how much money they receive.

As a member, you’ll learn ways to reduce taxes on Social Security benefits, on your retirement benefits, investments, and annuities. You’ll learn how to get every deduction to which you are entitled. And you’ll learn about some widely promoted strategies to avoid if you don’t want trouble with the IRS.

When the tax law changes, you’ll be among the first to know what to do about it — my readers knew the details of the 2017 tax reform shortly after it became law.

Here are just a few of the tax breaks Retirement Watch readers know…

- A little-known tax-saver that people who own employer stock in their 401(k)s must know.

- How to avoid the surtax on Medicare premiums.

- Why Florida and other no-income tax states might no longer be retirement tax havens. Moving to an income tax-free state might not help your nest egg last longer.

- How to make charitable gifts to increase your tax write offs and your income.

- Why reducing adjusted gross income now is the key to reducing your retirement tax burden.

- How to use last year’s 1040 as a tax and financial planning tool, and why it’s the best tool available.

- Why the oldest rule in the tax planning book — defer your taxes for as long as possible — might now be a mistake and cost you and your heirs thousands of dollars. This might be even more true after the 2017 tax reform.

You’ll learn about all these tax strategies and more when you join Retirement Watch and get your free report, The New Rules of Retirement.

RETIREMENT RULE #4

The New Focus of Estate Planning.

Estate planning is about a lot more than taxes.

Many people left their loved ones in difficult straits because they didn’t realize that, and many more are likely to in coming years.

Almost two decades of changes in the federal estate tax peaked in 2017.

The 2017 tax reform doubled the lifetime federal estate and gift tax exemption, essentially eliminating the taxes on all but a small number of estates. (But this change is effective only through 2025, and Congress could change it before then.)

Yet, estate planning is alive and well, and perhaps even more important than ever. But the strategies are different.

“Retirement Watch highlighted our inadequate estate and tax situations, prompting me to make changes per your comments.”

Thinking that estate planning is all about taxes, and that you no longer have an estate planning problem, would be a mistake — a colossal mistake that can cost you and your loved ones a bundle and create a lot of headaches.

Estate planning is about seeing that your hard-earned wealth goes to those you want to have it, and in the most efficient way possible.

Estate planning involves reducing family conflicts and reducing waste from high expenses, delays, probate, mismanagement, creditor claims, and more.

You’re exposed to all these risks even if you won’t owe a dime in federal estate taxes.

Perhaps even worse than ignoring estate planning is getting the wrong estate planning advice. Too many people don’t see a professional. Or they use an attorney who doesn’t specialize in estate planning. Or they settle for a “cookie cutter” estate plan.

I provide readers estate planning recommendations based on research and real-world advice. I warn my readers how a few little things can really mess up a plan and how you can prevent these mistakes from happening.

I’ve said for many years that estate planning is about much more than taxes.

You need a plan even when estate taxes will be zero. Perhaps the best effect of exempting most estates from federal taxes is that planners and their clients can focus on the non-tax issues of estate planning.

There are key issues that should be addressed in every plan, whether the estate is worth $500 million or has far fewer zeroes.

Even the simple act of making annual gifts to children and grandchildren is filled with traps and opportunities of which many people are unaware.

That’s why I recently completed the fifth edition of my book The New Rules of Estate Planning, and why I include estate planning strategies in almost every issue of Retirement Watch.

Perhaps the biggest mistakes in estate planning these days are made with IRAs and other retirement plans. Did you know that your IRA isn’t covered by your will? My readers know that and more.

- Why a Roth IRA can be an excellent estate planning vehicle.

- How to make your beneficiary designation form air-tight with four simple steps that practically guarantee your IRA custodian carries out your instructions.

- The one beneficiary you can name who never pays a single dime in distribution taxes. Bonus: Big tax savings for you, too.

- Two entities you should never name as IRA beneficiaries. You’re just handing your money over to the IRS if you do!

Of course, estate planning involves a lot more than IRAs.

Each month, you’ll get estate planning advice based on my research and real-world experience. Examples of what you’ll learn include…

- Why standard provisions in your will could cost your estate thousands under the latest law — or leave your spouse impoverished.

- Why the bypass trust remains valuable to many estate plans under the new tax law.

- Why the family home or vacation home often is the most difficult asset in an estate, and five ways you can solve this problem.

- Why “digital assets” need to be a key part of your plan and how to handle them.

- Why using joint ownership as a key part of an estate plan often is a bad idea.

- Shrewd ways to have your business pay estate taxes.

- When to use trusts in your estate plan; how to pick the right type of trust for you.

- How to avoid probate, and why you might not want to.

- 10 basic rules for every estate plan, whether you are Bill Gates or the sub-millionaire next door.

By joining Retirement Watch now, you’ll receive the report The 20-Minute Estate Plan. It contains the simplest, clearest explanation of estate planning you’ll find.

After reading it, you’ll have a good idea of what your estate plan should be. And you’ll be able to sit down with an estate planner to intelligently and economically put together the right estate plan for you.

You’ll save time, money, frustration, and end up with a superior estate plan. Regardless of how Congress changes the estate and gift tax law in the years ahead, you need to stay on top of every upcoming change.

With this valuable, free Special Report at your fingertips, plus your Retirement Watch membership, you won’t be at the mercy of anyone who wants control over your money.

Instead, you’ll be in charge — thanks to the reliable, unbiased estate-planning advice you’ll have at your fingertips.

RETIREMENT RULE #5

Protect Your Principal, Guarantee Your Income.

Guaranteed monthly income is the primary retirement goal of 34% of adults who aren’t retired. Another 40% want to ensure the safety of their nest eggs, regardless of market activity, according to a TIAA-CREF survey. There are ways to meet those goals, but there also are perils. And the perils are increasing, because it seems almost everyone is promising or implying that they’ll be able to provide safe, high income. You have to be careful.

I’ve guided Retirement Watch members through the world of safe, guaranteed income for years. Many people in pursuit of guaranteed income make the wrong choices. They receive too little income, pay too much in fees, or have their money tied up by too many restrictions.

A big reason for the mistakes is that most people seek guaranteed income the wrong way. You’ll learn what this is and the right way to secure a stream of lifetime guaranteed income after becoming a Retirement Watch member.

The right sources of guaranteed income let you sleep better, knowing you’ll never outlive your income.

There are other benefits. A study published in the Journal of Financial Planning found that putting 25% to 50% of a nest egg into an immediate annuity makes your nest egg last longer, ensuring you won’t run out of money.

Other studies agree. But it has to be the right kind of annuity, not the high fee, poor return vehicles many people are sold.

Unfortunately, financial services firms make everything needlessly complicated and expensive. That’s why so few people take advantage of their lifetime guaranteed income opportunities, and why many of those who try to take advantage make the wrong choices.

I cut through the malarkey, buzz words, hype, and smoke screens. I examine bells and whistles to determine which are worth the cost and which aren’t.

As a Retirement Watch member you’ll discover:

- How an annuity can fit into your total retirement package to enhance your financial security.

- How to increase your lifetime income 20% a year — guaranteed. I’ve researched this strategy every few years for over 30 years, and the result is always the same.

- An annuity that can help pay for long-term care expenses, tripling the amount you have available for long-term care benefits.

- How to avoid getting pressured into buying the wrong annuity. Here’s what you need to know to make sure you buy the annuity, if any, that’s right for you.

- Hidden fees and other traps to watch out for. They can take a bite out of your retirement nest egg if you’re not careful.

- Three types of annuities that protect you from inflation. How to decide which one is right for you — plus common traps to avoid.

You don’t have to depend on the investment markets for secure lifetime income.

As you approach retirement, you’re less interested in the next hot investment. You’re more concerned with protecting what you’ve earned and generating secure income from it. High levels of uncertainty in the economy and markets make this a higher priority.

RETIREMENT RULE #6

Maximize Guaranteed, Inflation-Adjusted Lifetime Income.

Most people think they know about Social Security, but few do.

Of workers 55 and older, 24% say they are “very, very confident” and 53% are “somewhat confident” they know enough to make the right choices about their Social Security retirement benefits.

Yet, in an eight-question quiz only 27% of these same people chose at least seven of the right answers.

Social Security is the most neglected and misunderstood tool in your retirement planning toolbox.

Many people — even financial advisors — don’t know the latest strategies and laws. Often, people make decisions that unintentionally and unknowingly reduce their lifetime guaranteed, inflation-adjusted income.

They leave tens of thousands of dollars of money on the table, money that could have gone to them and their heirs.

Almost everyone wants guaranteed, inflation-protected income. Few know that they already have a guaranteed, inflation- protected asset. What’s more, you can manage that asset to increase your retirement income if you know a few shrewd moves.

Social Security retirement benefits are the foundation of retirement income. They last for life and are guaranteed and inflation-protected. There is no investment risk.

There’s a lot more to Social Security than most people realize, and a few simple decisions can maximize these benefits. Social Security benefits can be maximized with little-known but perfectly legal strategies.

Few people or advisors poke around the Social Security law. If they did, they would get the most out of Social Security and increase peace of mind in retirement.

My readers already know the following:

- When does it make sense to delay benefits? What factors should you consider?

- Where can you find the best calculators for estimating Social Security benefits?

- In 2015 Congress changed the strategies for married couples. How do the changes affect your retirement income?

- Why one spouse probably should wait until age 70 to begin benefits and which spouse that should be.

- When it makes sense to suspend benefits after beginning them.

- What are the options and best strategies for widowed and divorced people?

- Can a divorced person claim his or her own benefits, the former spouse’s benefits, or benefits based on the current spouse’s earnings?

You can learn about these strategies and much more by becoming a Retirement Watch member.

You don’t go to the IRS to learn the best tax reduction strategies. Why do most people rely on the Social Security Administration for advice on their retirement benefits?

Take advantage of this opportunity to increase guaranteed, inflation-protected retirement income and provide a more secure, comfortable retirement.

Make the smartest and most-informed decisions about Social Security benefits that you can. Be sure you don’t leave money on the table for others to take. To discover how you can learn more details, keep reading.

Avoid the Retirement Surprises

You won’t hear many of my recommendations anywhere else. Not from mass market retirement books and magazine articles, not from your employer’s retirement seminars, and not from the talking heads.

That’s because retirement financial strategies are my passion. I enjoy studying the facts and teaching others the strategies I develop. I like examining the whole retirement finance picture.

I especially like being your independent financial advisor. I don’t get compensated by selling you investments and am not associated with a financial services firm selling its own line of products. In fact, I look for ideas that carry the lowest sales costs possible.

That’s why you should try Bob Carlson’s Retirement Watch. As a Retirement Watch member, you’ll profit from my detailed, independent research.

The Retirement Watch Advantages

-

You’ll be confident and secure in the soundness of your plan.

The bottom line at Retirement Watch is to let you confidently make decisions and plans about your financial future. You’ll know that the advice you read in each monthly issue is based on my independent, thorough research. I don’t have a hidden agenda.

You can read my advice with confidence. Confidence that I have researched the topic as thoroughly as I can, and confidence that I am giving you the same advice I would give to a close friend or family member.

That means you’ll own investments that let you sleep at night, and you’ll know exactly why each investment is in your portfolio and what you can expect from it.

-

You will pay lower taxes, perhaps dramatically lower.

Make no mistake that older Americans are a target for the taxman.

You have to plan and be vigilant to ensure that you don’t sneak into a marginal tax bracket of 70% or higher.

Retirement Watch readers know that they’ll learn the latest and best tax reduction strategies. They also know that they’ll be warned of tax traps and tax strategies that don’t work.

The tax law changes frequently and rapidly. You need a source you can rely on to bring the latest changes and strategies to you.

-

Your financial life will be much simpler

Your investments and every other aspect of your financial life will be greatly simplified.

I don’t throw out dozens of investment ideas and let the reader decide how to organize them. I put together portfolios of recommendations that people actually can follow.

Whether working on your estate plan, taxes, investments or other aspect of your finances, you’ll be able to cut through the babble, jargon, and numerous options in the financial marketplace to latch onto the ideas and strategies that will work for you.

And you’ll have time for the things you really want to do in retirement.

-

You’ll slash costs on all your financial services.

One of my goals is to help increase your wealth — steadily and safely. It is a whole lot easier to meet that goal if part of your money is not going to high commissions or other expenses.

I look for great financial ideas that have very low cost. That’s why you’ll save money — on your investments, insurance, taxes, estate planning, and more. You’ll increase your wealth even if you don’t change a single investment.

Most of my subscribers save far more than the cost of a subscription on the first few money-saving ideas they get from their monthly issues.

-

Your estate will go where you intended.

My readers know that their hard-earned wealth will produce the legacy they want. They will provide for their spouses, children and grandchildren as intended. They’ll benefit the charities of their choice. And their businesses will continue if that’s what they want.

The myths, mistakes, and oversights that plague most estate plans don’t trap my readers. They rest assured that the IRS will get the minimum possible of their estate and that the rest will be passed on to their loved ones.

-

You’ll know how to respond to changes.

Every aspect of retirement will change regularly. Investments, taxes, estate planning, health care, insurance — all these areas are in the midst of revolutionary changes that will continue.

You can be sure that I’ll be studying these changes, even anticipating them. Then I will bring you strategies and suggestions for improving your retirement plan and helping you to create the retirement you desire.

I’ve brought my members word on all the changes to date and have kept them ahead of the curve. The record is clear, and we’ll keep building on it.

What You Don’t Know About Retirement Can Hurt You

There’s an old saying, “Failure to plan is planning to fail.” That is especially true regarding retirement planning.

Earlier in this report I told you that there are good ways and bad ways to estimate the amount of money you’ll need for retirement. But a new study reveals that using any of these methods, even a bad one, is better than not doing an estimate at all.

That’s because those who make some attempt at planning end up accumulating about four times as much money as those who don’t plan at all.

They also are more confident and satisfied in retirement. In a word, those who plan have more successful retirements than those who don’t make some kind of plan.

Planning a successful retirement isn’t that difficult — if you have the right information. And that’s what I’ll provide you each month in Retirement Watch and in-between issues on the members’ website.

Each month I’ll bring you my latest research and insights on a range of retirement issues. I cover topics I haven’t even touched on in this report.

How many advisers come to you each month and…

…advise you on how to position your portfolio to benefit from the latest investment research and market trends?

…explain in clear, simple terms the key facts you need to know about estate planning, so you can design an estate plan that meets all your goals?

…demonstrate how you can leave your grandchild a comfortable nest egg — while barely cutting into your own standard of living?

…show you how to slash your taxes to the bone, legally and without trouble from the IRS?

…tell you how to get the most from an annuity, and when to avoid annuities?

…steer you away from traps and pitfalls in investments, estate planning, insurance, and tax reduction?

…bring you clear explanations of changes in health care?

…show you how to protect your family’s wealth from the uncertain costs of long-term care, and how to find the best strategy for you?

…show you exactly where you can get the best prices on life insurance, Medicare supplement insurance, and long-term care insurance?

…explain how you can simplify your finances (don’t most advisors seem to complicate them, so you’ll need more of their advice?), so that you’ll cut costs, save time, and make your wealth grow faster?

Most other advisors cannot do the amount of research I do. They are meeting with clients, searching for new clients, and managing their offices — all while trying to work for their current clients.

That’s what makes my monthly service so valuable, even if you already use one or more financial advisors. I bring you fresh ideas each month. When you believe one looks good for your situation, show it to your advisors and discuss how to use it.

I’m confident you won’t find another resource that does the kind of research I do, brings you the unique insights and strategies you’ll find in each monthly issue, and that covers the range of retirement financial issues you’ll find in Retirement Watch.

I want you to join our family of Retirement Watch members.

A one-year membership normally costs $249. As a special introductory offer, you can sign up for a full year for $57. That’s about 13 cents a day to get the best, most up-to-date retirement financial advice available.

You’ll also receive my big bonus report, The New Rules of Retirement, with its detailed strategies and recommendations FREE.

You’ll learn how to estimate your retirement needs, plan your estate, cut taxes, find the right health care package, and much more.

Plus, I’ll send you two additional bonus reports FREE if you join me for two years.

You’ll save 80% off the regular price and only pay $99 for two years AND you’ll get The New Rules of Retirement FREE along with…

FREE REPORT #2:

5 Easy Chair Portfolios to Fund Your Retirement Dreams explains how to set up your investment portfolio to earn safe, solid returns with a margin of safety. You’ll be able to hit the ground running with your first issue.

FREE REPORT #3:

Your 20-Minute Estate Plan provides you with estate planning recommendations based on research and real-world advice. I warn you how a few little things can really mess up a plan and how you can prevent these mistakes from happening.

I’ve been at this a long time, and I know I can deliver.

That’s why I’m happy to offer this 100% money-back guarantee to you for joining Retirement Watch.

100% Money-Back Guarantee

Sign up for your Retirement Watch membership. During the first 30 days, if you decide it isn’t for you, let us know and I’ll refund every penny you’ve paid, 100%. You can keep all the issues and materials you received, including the bonus reports, FREE.

With your 100% guarantee, why not sign up for the two year offer and receive all 3 bonus reports FREE? They are yours to keep regardless of what you decide.

You risk nothing, because I know people who read Retirement Watch often want to continue receiving it.

Make this your first money-saving, wealth-building step on the road to the retirement you desire. Sign up for Retirement Watch, and I’ll see that you’re sent my New Rules of Retirement and the other bonuses.

Yours for a better retirement,

Robert C. Carlson

Editor, Retirement Watch

P.S. Your best deal is to sign up for two years. You’ll save 80% off the regular price and receive all 3 bonus reports: The New Rules of Retirement, 5 Easy Chair Portfolios to Fund Your Retirement Dreams, and Your 20-Minute Estate Plan. This is such a good offer that more than half our new members take it. The reports are yours to keep, FREE, even if you cancel and get 100% of your money back.

P.P.S. In fact, to entice you even more to sign up for the two-year offer, I’m adding an additional 4 FREE reports – a total of 7 FREE REPORTS. It’s an unheard of offer, but I just don’t want you to miss this incredible opportunity to see for yourself how Retirement Watch has helped tens of thousands of people. All the reports are listed on the order form so click the button below to take a peek.