Stop Overpaying for Retirement Medical Care

Medicare open enrollment season is almost upon us again. This is your annual opportunity to improve your coverage or reduce costs or both. Even if you are satisfied with your coverage, review what’s available and compare it to your current coverage. Also, be sure to review changes your plan announced for next year.

The fact is, most Medicare beneficiaries overpay for their medical care. At least 90% of beneficiaries pay too much in out-of-pocket costs, according to Katy Votava of Goodcare.com, citing several studies. Other studies show that people pay premiums of up to twice what they should for Medicare supplement (Medigap) and long-term care policies because they don’t shop around. Medigap policies are standardized, so there’s little reason to pay a higher premium. Yet many people do.

Open Enrollment for existing Medicare beneficiaries begins Oct. 15 this year and closes Dec. 7. The coverage you select takes effect on January 1, 2017. During Open Enrollment, Medicare Advantage (Part C) members can switch to different plans. Traditional Medicare (Part B) members can change to Advantage plans if they want. Traditional Medicare members also can change their Medigap and Part D Prescription Drug plans. (Advantage members aren’t allowed to be sold Medigap or Part D plans; they already have that coverage.)

Keep in mind that there is no joint coverage for married couples. Coverage and any changes are individual for each spouse.

Everyone enrolled in Medicare has Part A coverage for hospitalization and only a few pay an additional premium for it. But the combination of Part A and Part B doesn’t cover all your medical care. There are premiums, deductibles, copayments and co-insurance. There also are types of care that aren’t covered or have limited coverage.

Beneficiaries in Part B Traditional Medicare need to consider whether to add Part D Prescription Drug and Medigap plans. Without these policies, you’re on the hook for all the expenses Parts A and B don’t cover. If you buy one or both of these policies, you’ll pay premiums for the coverage, so that will increase your annual fixed expenses. But the policies will pay some of the expenses not covered by Parts A and B if you incur them. Otherwise, you’ll have to dig into your nest egg to pay for those unexpected, unplanned medical expenses and won’t know what your maximum expenditures will be.

As I said, even if you have coverage and are satisfied with it, take advantage of Open Enrollment to survey the choices available to you. Medical insurance has been in upheaval the last few years. Some insurers are increasing premiums more than others. In Part D, some insurers quietly change the medications they cover.

Part B vs. Part C

Let’s start with the Part B versus Part C decision. The Part C Medicare Advantage plans have grown in popularity, taking about a third of Medicare beneficiaries.

The Advantage plans are managed care plans. All the elements of Part B, Medigap and Part D are offered through one plan. Doctors and care tend to be more coordinated and more proactive than under Part B, though not always.

Under some Advantage plans, you receive coverage as broad or broader than is available through a combination of Parts A and B, D and Medigap. Under Advantage plans, you pay extra if you want to see a doctor or other provider that is outside the plan’s network. You also need approval to see a specialist or have certain kinds of care if you want it covered. In Part B traditional Medicare, the plan pays the doctor of your choice if the doctor participates in Medicare. You also decide whether to see a specialist if the treatment meets Part B coverage, Medicare pays its share without requiring advance approval or telling you which specialist to see.

The coverage details vary between plans, so be sure to compare the different Advantage plans offered in your area. Review the discussion below on choosing a Part D plan, and apply those same steps to evaluate the drug coverage in Advantage plans. Some areas don’t have any Advantage plans available.

Comparing Medigap Plans

For those in Part B, look at Medigap coverage to close some of Part B’s coverage gaps.

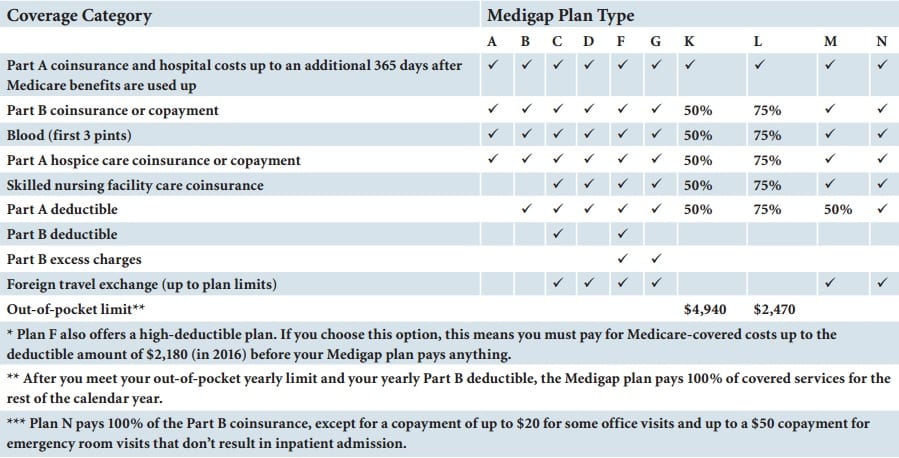

The policy offerings are standardized as shown in the chart. Medigap policies are standardized differently in Massachusetts, Minnesota and Wisconsin. You decide how many of the gaps and holes in Parts A and B you want covered. Then, you shop for the most attractive policy with that coverage available to you. For Medigap and Part D policies, insurers decide whether to offer a policy in a particular area and the premiums to charge in that area. Often, the decisions are made by county.

Plan F offers the broadest coverage. It pays basically all the deductibles and copayments in Part B as well as some items not covered by Parts A or B. Plan G has the next-broadest coverage. The only difference is that Part G doesn’t cover the Part B deductible, which is $166 in 2016.

The coming big change is that a law enacted in late 2015 eliminates Plan F beginning in 2020. You’ll be able to renew a Plan F policy after 2019 if you already are enrolled in Medicare. But new Medicare enrollees won’t have Plan F available. That is likely to be a problem for current Plan F enrollees. Since relatively younger, healthier people will no longer be signing up for Plan F policies, the premiums for those choosing to remain with Plan F are likely to rise rapidly. You’ll probably want to switch to Plan G or another plan at some point. Monitor the rate of premium increases and consider when you want to change.

When you first join Medicare, you’re guaranteed to be able to buy a Medigap policy. But after that, if you want to switch policies or buy one for the first time, coverage isn’t guaranteed. Insurers can decline to cover you.

Once you decide on the coverage you want, be sure to review all the offerings in your area. As I mentioned, studies show premiums for identical Medigap plans vary considerably. You can review your choices on the Medicare.gov website or by calling 800-MEDICARE (800-633-4227). Your Area Agency on Aging also might help. There are financial planners and insurance brokers who can work with you, but learn whether they deal with a limited number of insurers and therefore limit your choices.

Surveying The Part D Landscape

Finally, review prescription drug coverage. Prescription medications are the fastest growing medical cost and are the major medical expense for most seniors. Medications are another way Medicare beneficiaries overspend on their medical care because they don’t optimize their prescription drug coverage. Part B pays for very few prescriptions.

You need a list of all the medications you are taking, including details such as the drug name on the container, the dose, how often you take it and how often it is refilled. If you have a medical condition that might require medication in the future or there is a family history that makes you believe some medications are likely at some point, add that to your list as best you can.

Take a look at the Part D plans available to you, using Medicare.gov, 800-MEDICARE or other sources. Narrow down policies using the basics such as monthly premiums, deductibles and copayments. Then, dive into the details. Determine whether the medications you take or are likely to take are fully covered by looking at what’s called the plan’s formulary.

Some plans offer very different coverage for generics and brand names. Others cover only certain drugs for a condition, though other drugs are available. When you’ve found that one drug works better for you than the alternatives, be sure what you need is covered by a policy. Also, look for limits on dosages, number of refills, and length of time you can take the drug. All this should be available from the sources listed.

Finally, after narrowing the choices, contact directly the insurer offering your first choice. Be sure you have the latest information about what will be covered next year before you enroll.

Even if you are happy with your prescription drug coverage, do this work. Plans often change their details from year to year and don’t highlight the changes. It’s not unusual for a plan to cover a particular drug one year but not the next.

Medical expenses are one of your largest expenses in retirement. Be sure you don’t overpay for your care and are able to limit surprises.

![]()