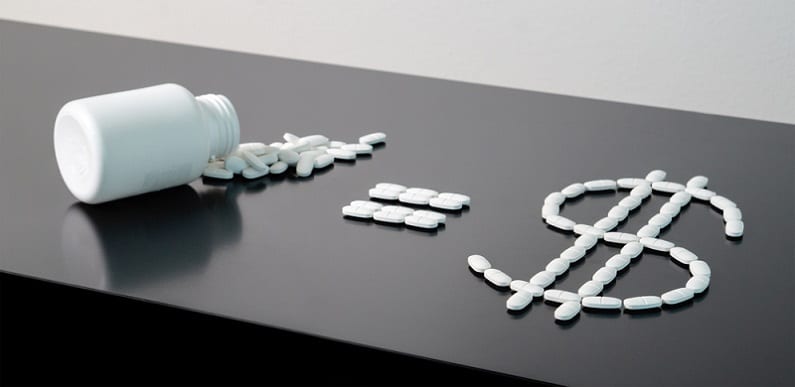

How to Quantify the Financial Effects of Prescription Drug Plans

The new Medicare Part D program is under way. In past visits we reviewed the key factors to consider when comparing plans for the new prescription drug benefit option.

Of course, the bottom line financial costs and benefits also are important. This month we look at how to quantify the financial effects of different plans. We also will look at a couple of longer-term financial consequences to consider.

Part D was created so that a person has to spend more than $3,600 annually on covered prescription medicines to really benefit from a plan. Above that level, the “catastrophic” drug coverage kicks in, paying for 95% of the cost of medicine above that level.

That is only the basic Medicare plan. Each company offering a plan under Part D can choose to increase the benefits and set the premium level accordingly. The true costs and benefits of a plan will depend on the individual’s need for prescription drugs. Here is how to use the basic Part D plan to compare all plans.

- First, total the annual premiums for a plan under consideration. Medicare does not reimburse this, and the premiums vary considerably from plan to plan.

- Second, determine how much you will pay out of pocket at each level of drug expenditures you incur. We’ll use the breakpoints of the Medicare plan:

Up to $250: This is the annual deductible. You pay 100% of medicine costs up to $250.

$251 to $2,250: You pay a 25% coinsurance amount in this range.

$2,251 to $5,100: You pay 100% of the costs in this range. This is the doughnut hole or gap we have discussed in past visits.

Over $5,100: At this level, your only costs under the model plan are the greater of a 5% coinsurance amount or a deductible of $2 for generic drugs and $5 for brand-name drugs.

- If you use prescription medicines regularly, estimate this year’s cost and see how much you would have paid under the different plans under consideration. Otherwise, simply compare the total costs at different levels of medicine use.

For example, suppose Max Profits estimated he used $3,000 of prescription drugs in 2005. He is considering Plan A with a $35 monthly premium that follows the Medicare model. His costs under the plan would be $2,170, computed as follows. The annual premiums total $420. He will pay the first $250 deductible. He’ll pay $750 as the 25% deductible for costs from $251 to $2,250. Then he will pay 100% of the last $750. The plan would save him $830 compared to having no prescription drug coverage.

It is easy to use the Medicare model plan in this way to compare the different offerings in your area. Determine your cost at different levels of drug use, and then decide which plan best meets your current and future needs.

The trickiest comparisons involve plans that are combining the prescription drug coverage with other medical benefits. These plans generally are offered by HMOs or PPOs and are known as private Medicare or Medicare Advantage plans. To compare these plans, review your estimated total out-of-pocket costs under different medical expense scenarios.

As we have stressed in past visits, remember to probe beyond the numbers. The biggest issue in many plans is the definition of “covered drugs.” Some plans give full coverage to only one brand name drug or only to generics for each disease. Plan members have to pay a higher share of the cost for non-covered drugs. Also, determine if you must receive the drugs from only one retailer or through the mail.

One factor that is difficult to compare is the cost of the drugs. Each plan negotiated its own costs for different drugs with the manufacturers. In many cases, that will differ from the regular retail prices. Someone who does not use a lot of drugs and has access to a good discount plan might save money at least in the short run by staying out of the Medicare plans and avoiding the monthly premiums.

Here are a couple of other questions that come up.

Is the government forcing you to join a Part D plan? Not exactly. Choosing a Medicare prescription drug plan is optional for every Medicare beneficiary.

There is a strong incentive for many people to choose a plan by May 15, 2006. If a plan is chosen after that date by someone who is eligible today, the monthly premiums will be increased by 1% for each month that enrollment is delayed. There is an exception for people who currently are enrolled in a drug plan, such as an employer or union plan. So, you are not required to join a plan today, but it will cost more to join one in the future. The government does not want all the healthy individuals avoiding the plans today and enrolling in the future when their prescription drug needs increase.

Is the government pushing you out of traditional Medicare? Again, not exactly. But beginning Jan. 1, 2007, the premium for Medicare Part B will be means-tested. Those with higher incomes will pay higher premiums. In 2005, each Medicare beneficiary pays 25% of the estimated cost of Part B coverage; Medicare pays the rest. The actual cost is estimated at $312.80 per person per month; the Part B premium is $78.20 per month, and Medicare pays $234.60 per person per month.

In 2007, individuals with annual incomes below $80,000 and married couples with incomes below $160,000 will continue to pay 25% of actual costs as the Part B premium. But individuals with incomes above $80,000 and up to $100,000 will pay Part B premiums of 35% of the cost. If income is above $100,000 up to $150,000, the premium will be 50% of the cost. Above $150,000 up to $200,000, the premium will be 65% of cost, and above $200,000 the premium will be 80% of the Part B cost. For married couples, double the individual income levels to determine the premium brackets.

That means at 2005 costs, an individual with income over $200,000 will pay a monthly Part B premium of $250.24 under traditional Medicare.

In addition, the Part B deductible increased from $100 to $110 in 2005 and now will increase by the same percentage as the Part B premium each year.

Because of these price increases, some believe that at least higher income seniors have a strong incentive to join a Medicare Advantage plan instead of staying in traditional Medicare. Keep these coming cost increases in mind as you compare different prescription drug plans.

![]()