Understanding the Estate Tax

The federal estate tax is paid on the value of property a person owned at the time of his or her death.

In 2021, the federal estate tax only applies to estates with values exceeding $11.7 million. The amount is indexed for inflation each year.

How Estate Tax Works

To determine whether the federal estate tax might be owed and compute the amount of the tax, start with the value of all assets owned by the individual. Identify all the assets and estimate their fair market value. Some assets might need a professional appraisal, but most assets can be valued without a formal appraisal. You also add back any taxable gifts the deceased made during life.

After the value of the estate is determined, certain deductions are allowed. All expenses of administering the estate are deducted. In addition, there is an unlimited deduction for all assets bequeathed to the surviving spouse of the deceased. So, an easy way to avoid the estate tax on your estate, but perhaps only delay it, is to leave your entire estate to your spouse. There’s also an unlimited deduction for charitable contributions made from the estate.

After taking the deductions, the remaining amount is the taxable estate. You apply the federal estate tax rates to this amount to compute the estate tax. Any gift taxes paid during the deceased’s life are subtracted.

But the federal estate tax has a credit that exempts most estate from taxes. The credit for 2021 effective exempts from federal estate taxes taxable estate of $11.7 million or less. In addition, if the deceased was predeceased by a spouse, any unused estate tax credit of the first spouse to pass away might be available to the surviving spouse to further reduce estate taxes. The executor of the first spouse to pass away had to make an election when filing the estate tax return to allow the surviving spouse’s estate to use the unused estate tax credit.

Estate tax rates can range from as low as 18% for taxable amounts of $0 to $10,000 over exemption to as high as 40% for taxable amounts of $1,000,000 or more over exemption. As an example, if an estate is worth $13 million, then $1.42 million would be taxed at a rate of 40%.

If the deceased’s assets exceed the exemption amount, the executor must file a federal estate tax return within nine months after their passing.

The computation of the estate tax reveals the different ways to reduce the tax. As Bob Carlson, editor of RetirementWatch.com, said, “There are four basic strategies for reducing estate taxes: removing assets from the estate, removing future appreciation from the estate, increasing deductions, and buying life insurance.”

Which States Have an Estate Tax?

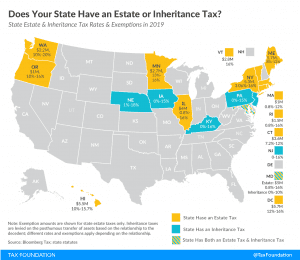

While an estate may be able to bypass the federal estate tax, it still might be subject to state estate taxes. Only 12 states and the District of Columbia have an estate tax as of 2020. These states tend to have much lower asset thresholds than the federal estate tax. The graphic below depicts all of the states with either an estate tax or an inheritance tax, along with the specific exclusion amount for each state.

Source: Tax Foundation

While similar, an inheritance tax is not the same as an estate tax. An inheritance tax is payable by the beneficiary, while estate taxes are paid out of the deceased’s estate.

Estate taxes are complex and are constantly changing. The exclusion threshold for those who have to pay the federal estate tax changes every year. There are many ways that a person can reduce or avoid federal estate taxes.

Important assistance for this summary of “Understanding Estate Tax” goes to Bob Carlson, editor of the Retirement Watch financial advisory service and chairman of the Board of Trustees of Virginia’s Fairfax County Employees’ Retirement System with more than $4 billion in assets.

Jaxon Kim is an editorial intern with Eagle Financial Publications.