The Economy and the Stock Market – Our Three Likely Scenarios Updated

Is 2019 going to be like 2015? Or will it bring a serious bear market and perhaps a recession?

In 2015, the U.S. labor market was strong, and the economy was growing. So, the Fed ended quantitative easing. As the year went on, the debt crisis in Greece roiled markets. China’s stock market took a steep dive, and Puerto Rico was having financial problems.

Markets started to react. The 10-year treasury yield rose from 1.68% on Jan. 30 to 2.49% on June 26. The S&P 500 tumbled about 15% from its May high to its August low and stayed near the low until early October.

Economic data sagged as the year went on. The 12-month rate of change in the Industrial Production Index turned negative, and that’s of-ten a sign of an imminent recession.

Yet, a recession didn’t occur, and U.S. stocks didn’t enter a bear market. Stocks and the U.S. economy began soaring after another tumble in early 2016.Today is developing a lot like 2015. The Fed began tightening significantly in 2018. Stock markets tumbled, and the global economy is slowing. There’s been bad economic news out of China and Europe. Italy has replaced Greece as a major risk in Europe, and Italy is a much bigger economy.

In addition, today we have global trade conflicts we didn’t have in 2015.In the December 2018 issue I laid out three likely scenarios for the economy over the next year. Since the Fed paused in its tightening policy, the worst-case scenario of the Fed tightening too much isn’t likely to occur, unless the Fed already went too far.

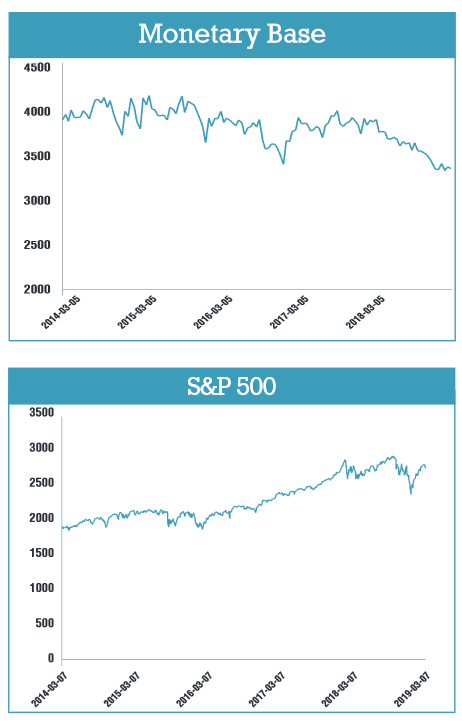

The second and most optimistic scenario is the central banks step in by increasing the monetary base as they did in 2016. The European Central Bank (ECB) announced just that in March, previewing a new stimulus program. But the Fed is unlikely to follow unless the economy slows consider-ably. The Fed doesn’t have a lot of tools left and wants to save what it has for when it’s really needed. Also, new monetary stimulus isn’t likely to be as effective now as it was a few years ago. That leaves the third scenario. The Fed stands pat for a while to see what happens, which is what the Fed announced in late January.

Because it takes time for monetary tightening to spread through the economy, I think U.S. and global growth will continue to slow. Most new economic reports are worse than their predecessors and worse than prior expectations. I expect that growth will reach a plateau at a 2% or lower growth rate. It could remain there for some time.

But even that result isn’t a given. Growth is low and falling in Europe and Japan, and Europe is struggling with the Italy problem. Either economy could drag down global growth. China is using both monetary and fiscal stimulus to maintain its growth around 6%. But a stumble there also would harm growth everywhere else. Since late December, however, U.S. stocks acted as though it’s early 2016 again, and we’re about to embark on another spree of monetary and fiscal stimulus.

That’s easy to understand. Each time the markets and economy stumbled following the financial crisis, the Fed or Washington stepped in with fresh stimulus.

Yet, divided government in Washington makes fiscal stimulus unlikely, and the Fed is hesitant to provide additional monetary stimulus beyond its announcement that it will stop raising interest rates for a while. And the Fed will continue to reduce its balance sheet for at least a few more months. That’s a form of tightening.

U.S. stocks are priced for a continuation of economic growth exceeding 3% and strong earnings growth. That looks too optimistic to me given the headwinds facing both the economy and earnings. This is a good time for investors to be cautiously optimistic. We do that by holding diversified, balanced portfolios and ensuring there’s a margin of safety in each of our positions.

![]()